About DHB Bank

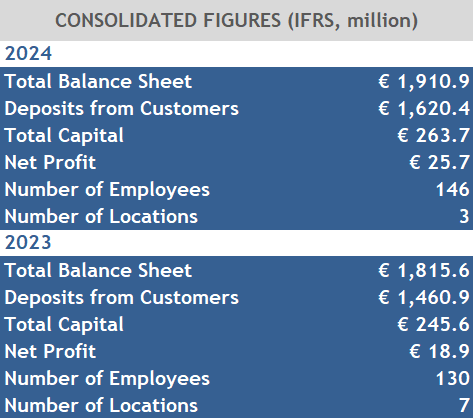

Summary Info about DHB Bank

- Established in 1992, with head office in Rotterdam in the Netherlands.

- Banking license from Dutch Central Bank (De Nederlandsche Bank- DNB).

- Savings and deposit products covered under the Deposit Guarantee Scheme (DGS)

- Traditional banking business model with activities Europe-wide:

+ Essential deposit products to customers in the Netherlands and Germany - via Internet and call centers.

+ Customized loan products to companies mainly in Europe - via direct contacts.

- Presence in the Netherlands, Germany and Türkiye.

- Sound risk management principles, strong capitalization, consistent profitability with focus on core business while avoiding speculative activities

- Detailed information on DHB Bank, including financials, available in the annual reports.