Sustainable Banking with Fast, Flexible, Fair Products and Services

- Easy and simple products for individuals

- Tailor-made solutions for corporate entities

- Swift and high quality service

Personal Banking

Savings and Deposit

Countries >

Personal Banking

Loans in Belgium

Corporate Loans

Loans for Businesses

About DHB Bank

Get to know more!

Contact

Get in touch!

ESG in DHB Bank Environmental, Social and Governance

DHB Bank recognizes that, as a financial institution, our activities have an impact on the environment and society. Therefore, we integrate sustainability principles into our decision-making processes and corporate culture. We aim to drive positive impact by aligning responsible practices with sound financial strategies.

New Campaign in Germany €25 Bonus to Our New Customers!

DHB Bank gives away €25 bonus to new customers who complete their identification process digitally via Verimi instead of Postident identification.

The only condition of this campaign is transferring a minimum amount of €2.500 to newly opened DHB Netspar account within 14 days after the account opening. Once the new DHB Netspar account balance reaches €2.500 or more, the bonus amount is credited to this Netspar account on the same day evening (or on the first working day evening if account opening day is holiday).

This campaign is only valid in Germany.

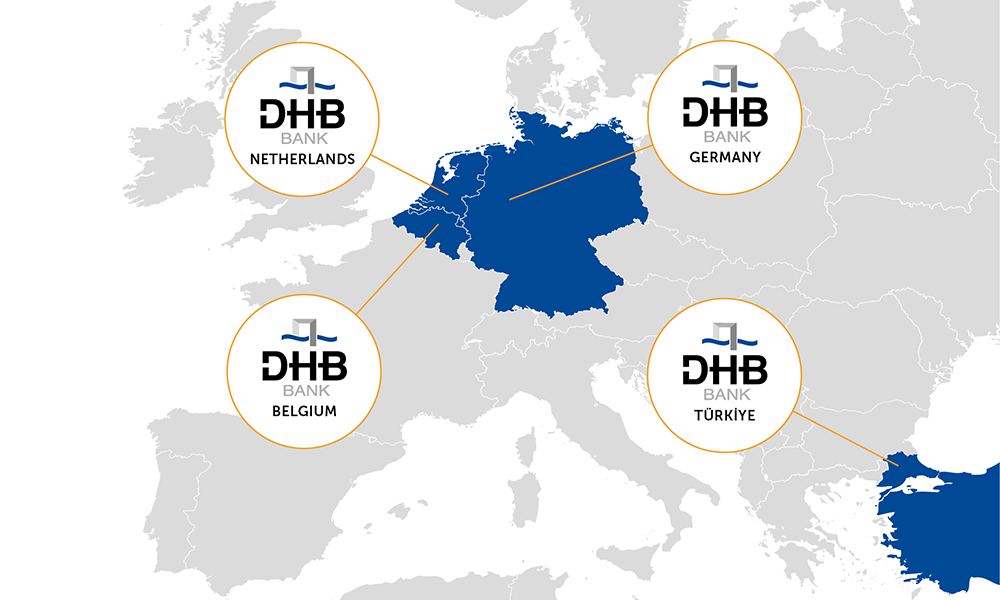

Global Expertise, Local Commitment

At DHB Bank, we offer a comprehensive range of financial services across mainly Europe, among other countries worldwide. With a strong local focus and a global perspective, we're strategically positioned in the Netherlands, Belgium, Germany, and Türkiye to provide tailored financial solutions for your international business needs.

We understand that behind every transaction there is a story, a vision, and a dedicated team. Let's embark on your international journey together, building a partnership based on trust and collaboration.

Banking with a warm welcome

Do you find yourself in search of a capable and personable partner to aid in your financial journey? We're excited to engage with you and discuss how our services can align with your specific goals.